Does Afterpay Affect Credit Score? Secret Insights for Liable Loaning

Does Afterpay Affect Credit Score? Secret Insights for Liable Loaning

Blog Article

Exploring the Partnership Between Afterpay and Your Debt Ranking

In the period of digital repayments and versatile spending alternatives, Afterpay has actually become a popular option for consumers looking for to manage their acquisitions conveniently. Nevertheless, among the benefit it offers, inquiries stick around regarding exactly how utilizing Afterpay might impact one's credit scores rating. As individuals browse the realm of personal financing, recognizing the intricate partnership in between Afterpay usage and credit report ends up being paramount. It is crucial to explore the nuances of this link to make educated decisions and safeguard financial well-being.

Afterpay: An Overview

Afterpay, a famous gamer in the buy-now-pay-later market, has actually swiftly acquired popularity amongst customers looking for versatile repayment solutions. Established in Australia in 2014, Afterpay has increased worldwide, supplying its solutions to millions of consumers in numerous countries, including the USA, the United Kingdom, and Canada (does afterpay affect credit score). The platform allows consumers to make purchases immediately and spend for them later on in four equivalent installations, without sustaining passion charges if settlements are made on schedule

One secret feature that sets Afterpay apart is its seamless combination with online and in-store retailers, making it hassle-free for individuals to access the solution throughout a wide variety of shopping experiences. In addition, Afterpay's straightforward application procedure and immediate approval choices have added to its allure amongst tech-savvy, budget-conscious customers.

Recognizing Debt Ratings

As consumers engage with different financial solutions like Afterpay, it comes to be necessary to comprehend the value of credit score scores in assessing people' credit reliability and monetary security. A credit history ranking is a mathematical depiction of an individual's creditworthiness based on their credit rating and existing monetary status. Credit scores scores are used by lending institutions, proprietors, and also companies to examine an individual's integrity in taking care of economic commitments.

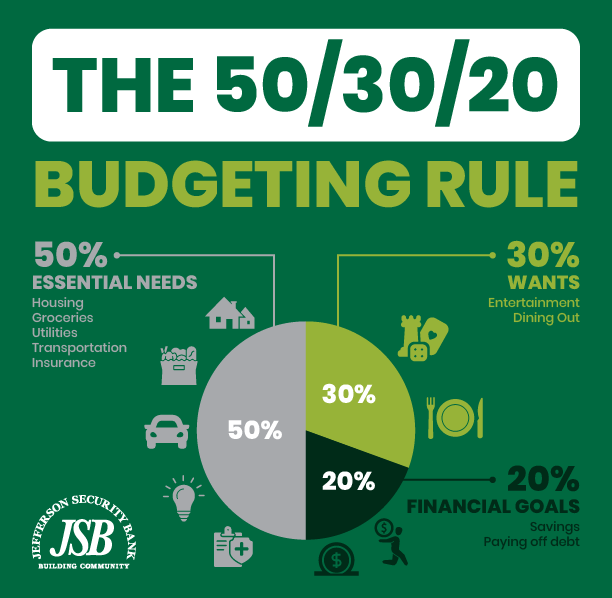

Credit rating rankings commonly range from 300 to 850, with greater scores indicating a lower credit scores danger. Factors such as settlement history, credit score utilization, size of credit rating, kinds of credit history accounts, and brand-new credit questions affect an individual's credit score ranking. A great credit score score not only raises the chance of loan approvals however additionally enables accessibility to much better rate of interest and terms.

Recognizing debt ratings encourages people to make educated economic decisions, construct a favorable credit rating background, and enhance their total economic health - does afterpay affect credit score. Regularly monitoring one's credit rating report and taking actions to preserve a healthy credit rating can have resilient benefits in taking care of funds effectively

Factors Affecting Credit Rating

Keeping credit score card equilibriums reduced in relationship to the readily available credit rating limit demonstrates liable financial behavior. The size of credit rating history is an additional aspect considered; a longer history typically mirrors even more experience managing credit rating. The mix of click resources credit history kinds, such as credit scores cards, mortgages, and installation fundings, can impact the rating positively if taken care of well.

Afterpay Usage and Credit Scores Rating

Considering the effect of numerous financial decisions on credit scores, the utilization of services like Afterpay can offer unique considerations in reviewing an individual's credit rating. While Afterpay does not conduct credit history checks prior to authorizing individuals for their service, late payments or defaults can still have consequences on one's credit score record. When individuals miss out on settlements on their Afterpay acquisitions, it can lead to adverse marks on their credit rating data, possibly reducing their credit history rating. Considering that Afterpay's time payment plan are not constantly reported to debt bureaus, liable usage may not directly effect credit rating favorably. Nevertheless, regular missed settlements can reflect poorly on a person's credit reliability. Additionally, constant use Afterpay may suggest monetary instability or a lack of ability to take care of expenditures within one's means, which can additionally be factored into credit rating assessments by loan providers. For that reason, while Afterpay itself might not straight influence credit history, exactly how people manage their Afterpay accounts and linked payments can affect their total credit report ranking.

Tips for Taking Care Of Afterpay Sensibly

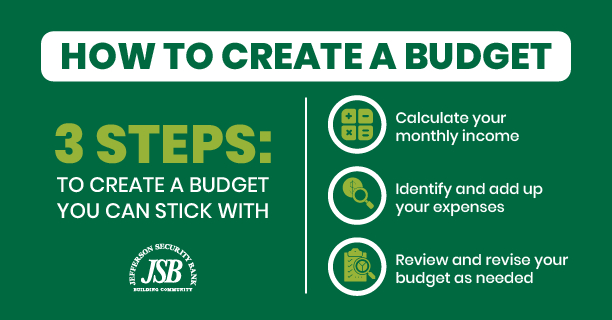

To effectively manage Afterpay and maintain monetary security, it is important to follow a regimented repayment schedule and click this site budgeting approach. Setting a spending plan that consists of Afterpay purchases and making sure that the repayments fit within your total economic strategy is important. It is necessary to only make use of Afterpay for items you genuinely need or budgeted for, as opposed to as a means to spend too much. Monitoring your Afterpay transactions on a regular basis can aid you remain on top of your settlements and stay clear of any type of surprises. In addition, monitoring your total amount impressive Afterpay balances and due dates can protect against missed repayments and late costs. If you locate yourself battling to pay, reaching out to Afterpay or creating a settlement strategy can help you prevent damaging your credit scores rating. By being liable and aggressive in handling your Afterpay use, you can take pleasure in the convenience it offers without compromising your economic wellness.

Final Thought

To conclude, the partnership between Afterpay and credit report ratings is complicated. While using Afterpay can influence your credit report, it is not the only aspect to take into consideration. Taking care of Afterpay properly by making prompt payments and preventing overspending can help mitigate any kind of adverse results on your debt rating. It is essential to comprehend just how Afterpay usage can affect your creditworthiness and take actions to keep a healthy credit report.

Elements such as payment background, credit use, size of credit scores history, kinds of debt accounts, and brand-new credit scores questions affect a person's credit history score.Taking into consideration the effect of numerous monetary decisions on credit report scores, the usage of services like Afterpay can present distinct considerations in reviewing an individual's credit history ranking. When users miss settlements on their Afterpay purchases, it can lead to adverse Read More Here marks on their credit score file, potentially decreasing their credit report score. Because Afterpay's installation plans are not constantly reported to credit history bureaus, liable use may not straight influence credit report ratings favorably. While Afterpay itself might not directly effect credit rating ratings, just how individuals handle their Afterpay accounts and associated settlements can affect their total credit rating.

Report this page